In our June 6, 2016 post the Real Win Worth (RWW) Assessment was introduced (1). This is a very useful tool for a new product development team to work through early in the development process. The tool asks three key questions related to the proposed new product:

- Is It Real?

- Can We Win?

- Is it Worth It?

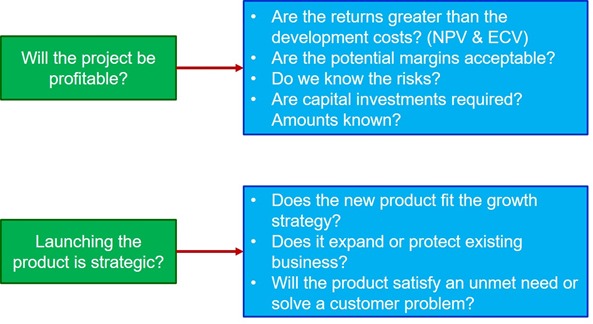

In this post we will dive deeper into the the third question, “Is It Worth It?’

1. What is the Value Proposition?

- Does it solve a customer problem?

- Does it provide a solution to a customer or market unmet need?

- Save them money? (lower the total cost of ownership)

- Does it enable the customer to get new customers, thus increasing their revenues and profits?

2. Can you estimate the gross profit for this new product? Or potential profit margin for this new product?

3. Do you have an estimate of the sales projections for the next five years? (Understand that you might not have very precise information early in the project, use your experience, instincts and any market data to develop an estimate)

This section is the most difficult if you don’t have good total available market data and sales projections for the new product. One of the desired goals of this section is to calculate the Net Present Value (NPV) for the new product. The NPV will address the question whether the returns are greater than the capital investment required. Another financial assessment tool is the Expected Commercial Value (ECV). The Expected Commercial Value (ECV) is a risk adjusted Net Present Value that takes into consideration all of the development costs (technical and commercial), the capital costs, the probability of commercial success and the probability of technical success.

In order to complete the financial assessment, you will need estimates for the following investment costs:

- Capital costs (does the new product require new equipment) (used in the NPV calculation)

- Development costs (R&D costs, engineering, scale-up costs (includes modifications to existing equipment if they don’t require new capital). These costs are used in the ECV calculation.

- Commercialization costs (marketing and advertising, sales team training, distribution costs if used). These costs are also used in the ECV calculations.

Most people get uncomfortable when they get to this section. Relax and understand that early in the development process, all potential new products will have only estimates for these investments. Do the best you can and rely on previous new product development projects to estimate the capital, R&D, and engineering/scale-up costs.

After the Forth of July holiday we will be back with a discussion of Net Present Value (NPV) and more detailed discussion on Expected Commercial Value (ECV).

Leave a Reply