Let’s pick up again with a discussion on the new product portfolio analysis process. There are some very good references in the literature on various ways to conduct new product portfolio analysis with a good overview of the portfolio process provided by Copper, Edgett, and Kleinschmidt (1). To be fair, the answer to the question “What is the right process” is there isn’t any one right process. The portfolio process needs to be tailored to the individual business or business unit. In the next few posts we will provide a high level view of some of the tools and processes used to analyze a portfolio of potential new products.

Let’s pick up again with a discussion on the new product portfolio analysis process. There are some very good references in the literature on various ways to conduct new product portfolio analysis with a good overview of the portfolio process provided by Copper, Edgett, and Kleinschmidt (1). To be fair, the answer to the question “What is the right process” is there isn’t any one right process. The portfolio process needs to be tailored to the individual business or business unit. In the next few posts we will provide a high level view of some of the tools and processes used to analyze a portfolio of potential new products.

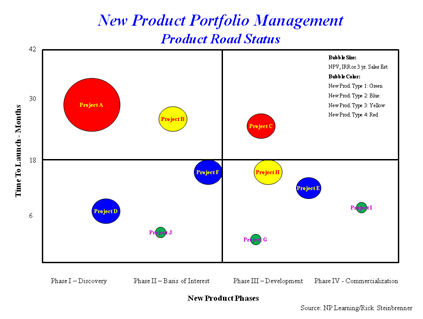

Portfolio tools can be qualitative (strategic stance 4X4, bubble charts, Product placement roadmaps) or quantitative like Net Present Value (NPV) and Expected Commercial Value (ECV) or a combination of the two. We will present some bubble charts in subsequent posts that combine a graphical view with some of the features (bubble size or color) to represent financial metrics like ECV or resources. I like these the best since they are easily interpreted and have a nice balance of the qualitative and quantitative elements of each new product.

In order to begin the portfolio process, some basic information on each project is required. Copper (2) calls this “up front homework.” If you are new to using a portfolio process, the thought of just beginning can be daunting. The best way to get started is to “crawl, walk, and then run.” The first time (or even after multiple portfolio reviews) you will likely find gaps in the information needed to make good decisions. That’s OK. Go and do the homework needed to get the right information. Sometimes this will be customer or market data or technical feasibility, potential costs (development and commercialization costs), and resources available. Some projects will require very specific resources (like the right chemist or engineer) or the account representative with excellent relationships with key customers.

A good tool to evaluate each new product in the portfolio is the Real-Win-Worth analysis (3). I used this tool at AlliedSignal in the mid 1990’s when we instituted a full portfolio process in the Engineered Materials Sector. The tool guides the user to answer the following three key questions:

- Is it Real?

- Can We Win?

- Is it Worth It?

Seems like a simple set of questions, but once you start to dive into each project and start to dig deeper sometimes answering these three questions can be difficult.

At a high level,

- Is is Real? analyzes if the market is real and if the product is real. Is there an unmet market need or customer desire for the product. On the technical side, is there a clear product concept, can the product be made (i.e. technically feasibility demonstrated)

- Can We Win? investigates what are the barriers to entry, such as Intellectual Property (patents that might block the potential key technical features), do we have the right marketing and sales channels, does the team have the right resources to develop a differentiated product, and how will competitors respond to the new product.

- Is is Worth It? uncovers primarily the financial aspects of the product development and commercialization. It looks at the financial return (using NPV or ECV) and analyzes the risks. Additionally, this part evaluates if the new product fits the overall product development strategy. Successful new products fit nicely into the strategic plans and as such will have top management support.

In the next series of posts we will provide more details on how to answer each of the three questions.

References

1) Robert J. Cooper, Scott J. Edgett, and Elko J. Keinschmidt, Portfolio Management for New Products, Second Edition, 2001, Basic Books, (Perseus Books Group)

2) Robert J. Cooper, Winning at New Products, Third Edition, 2001, Perseus Books Group

3) George Day, Harvard Business Review, December 2007

Leave a Reply